Streamlined Lending, Designed for Banking Systems

Overcoming Roadblocks in Auto Lending

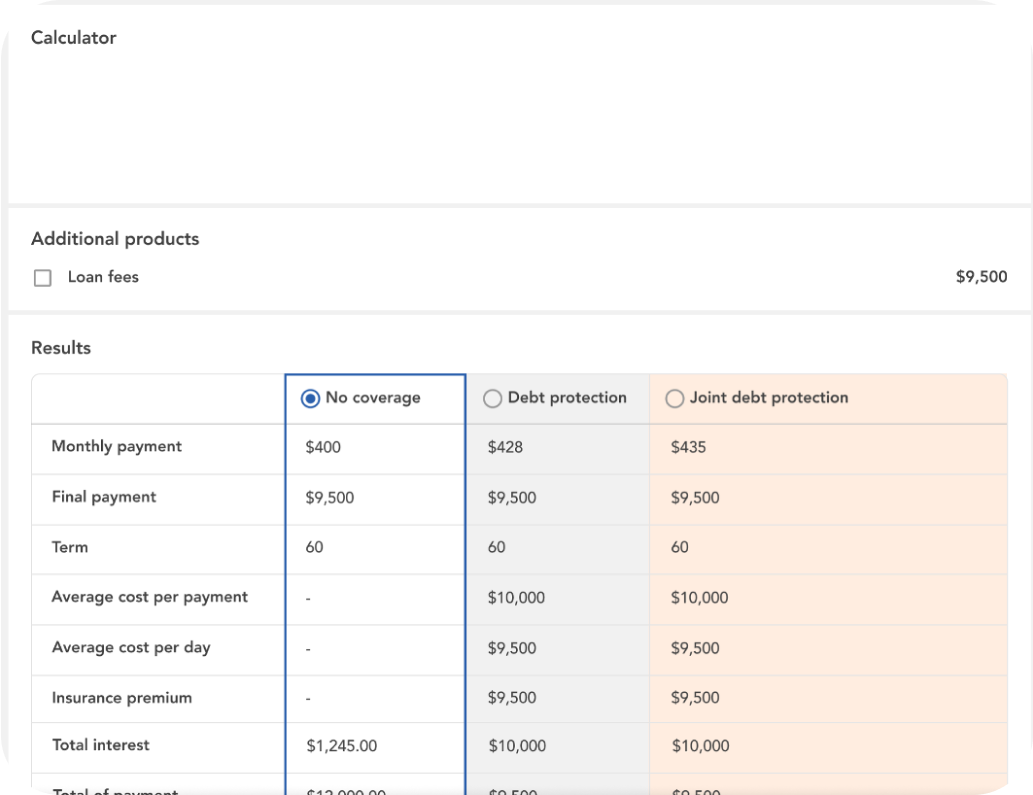

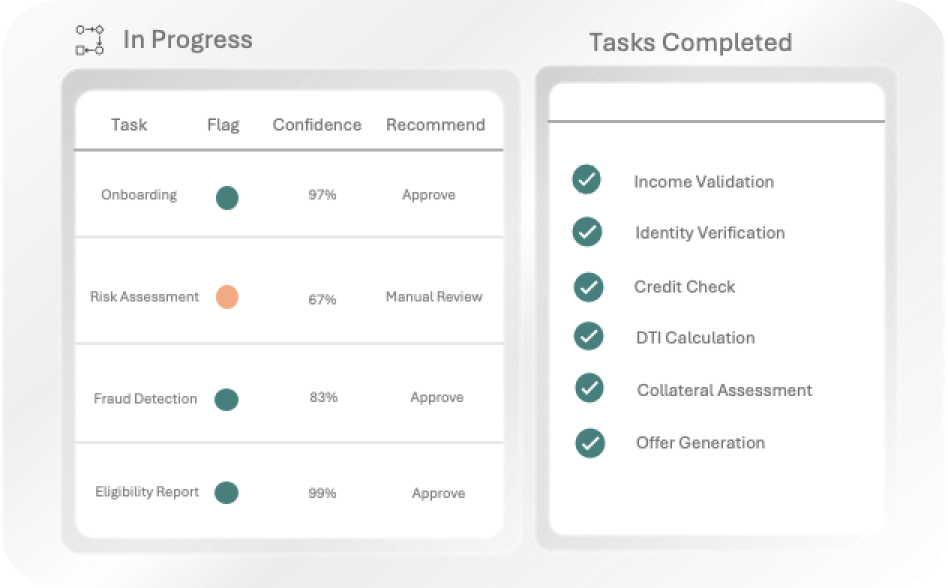

Loan Processing Bottlenecks

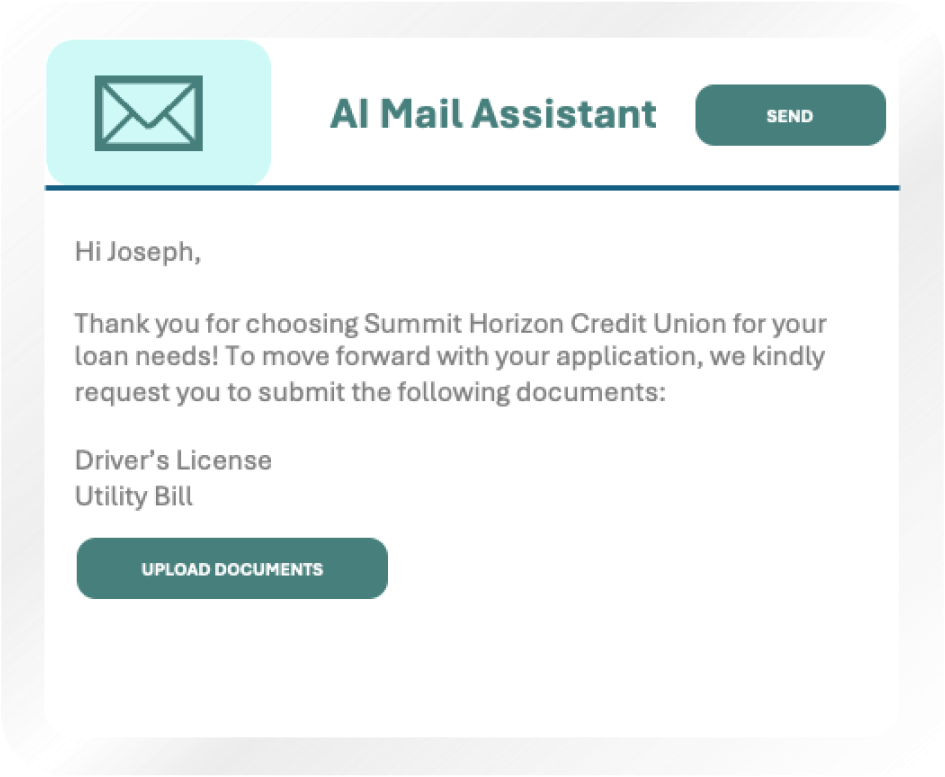

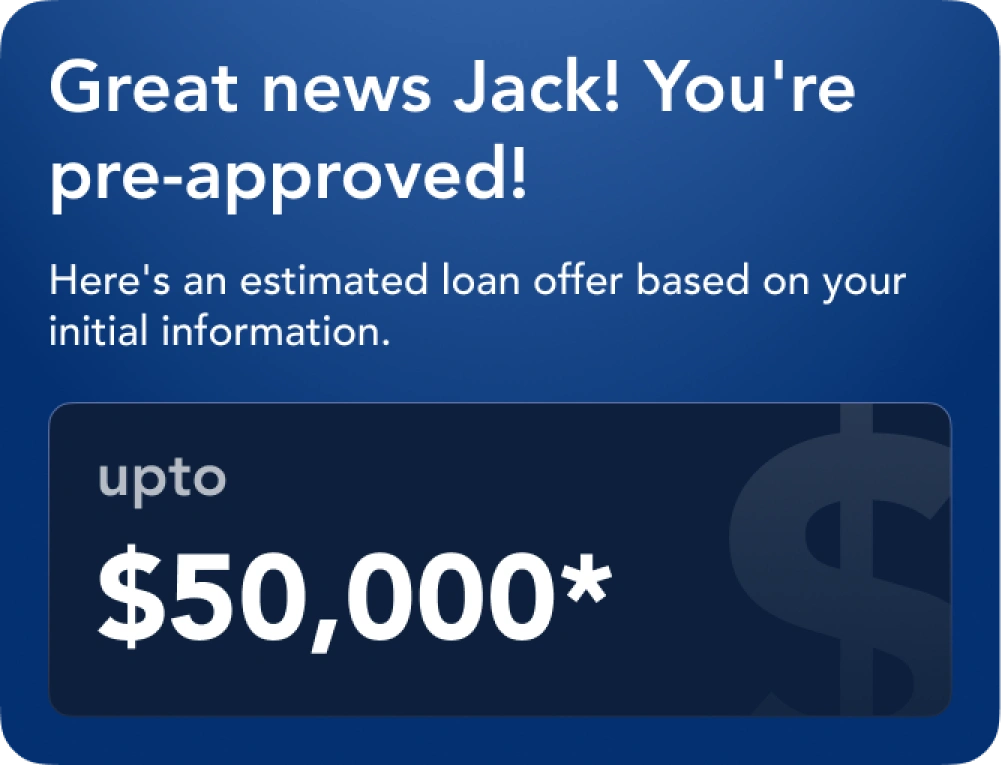

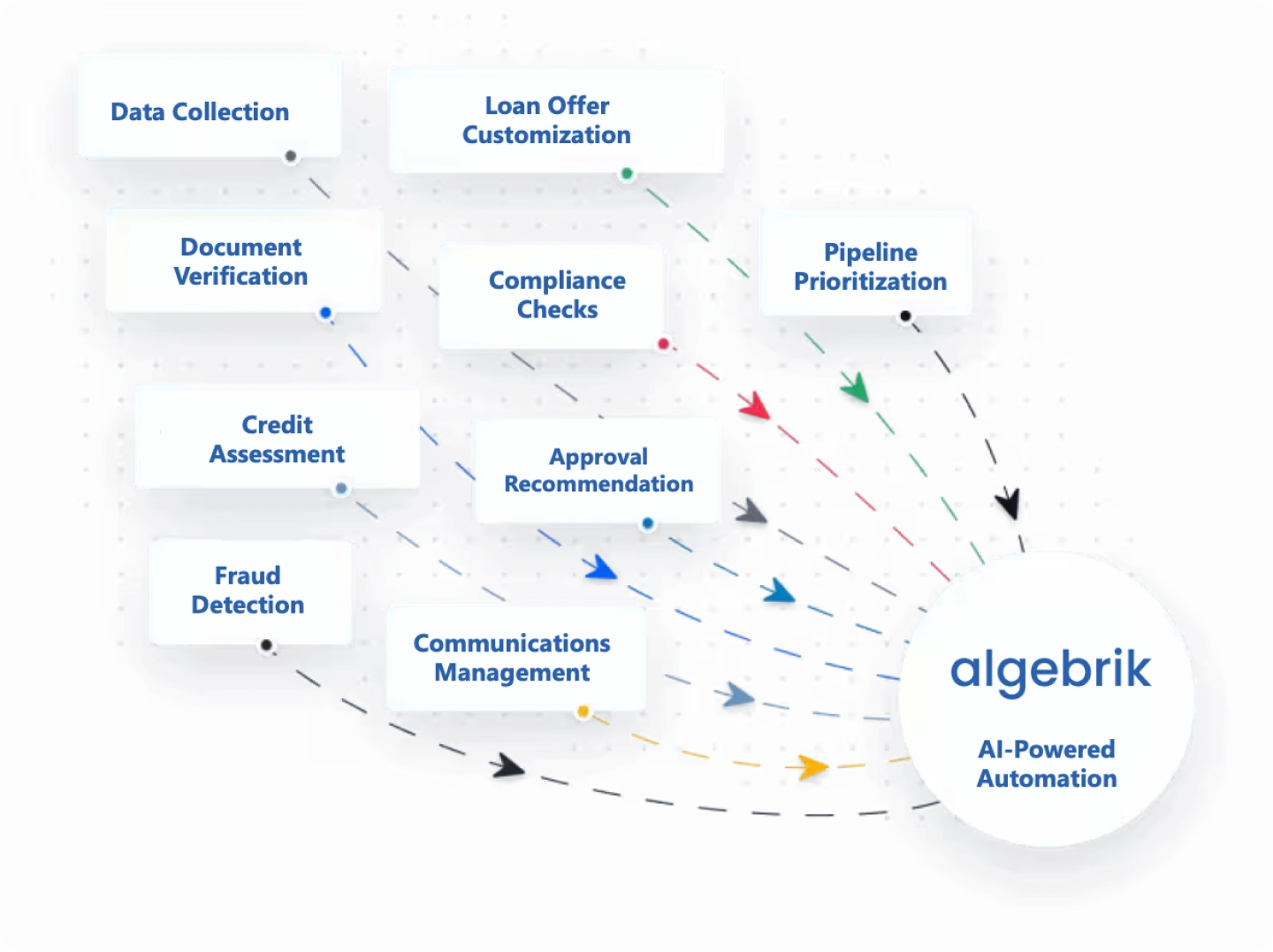

Lengthy approval cycles hinder growth and frustrate borrowers.Algebrik streamlines processing with automation, enabling faster approvals and better scalability.

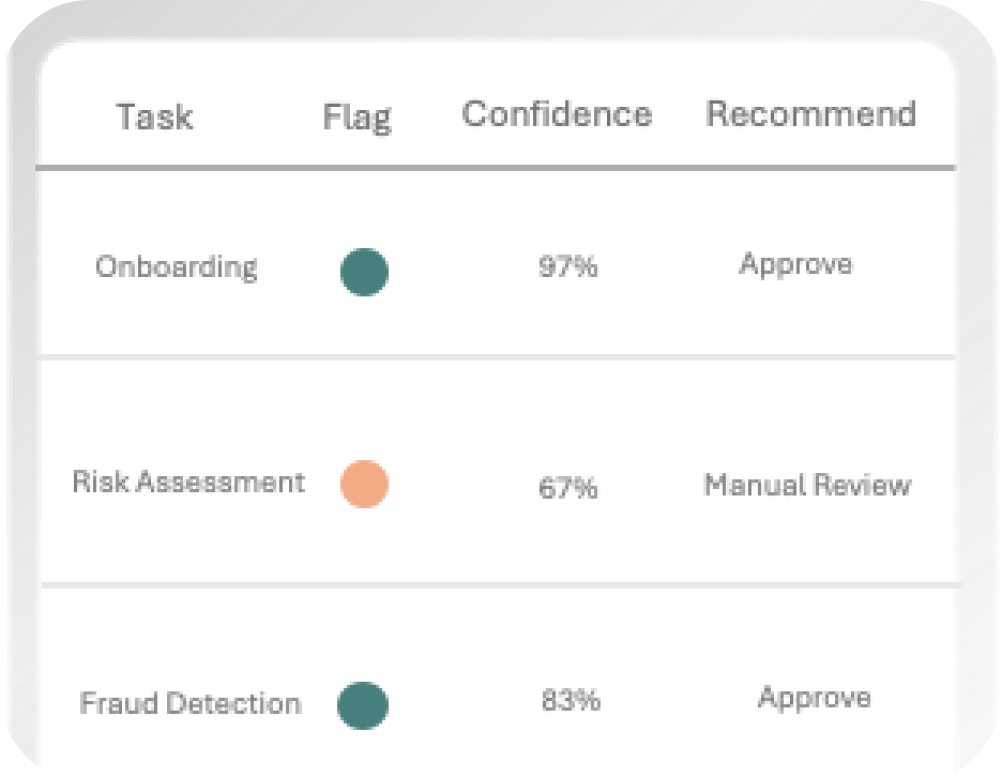

Risk Assessment Accuracy

Inconsistent evaluations increase the risk of defaults and poor lending decisions.AI-driven risk models ensure accurate credit assessments and smarter decision-making.

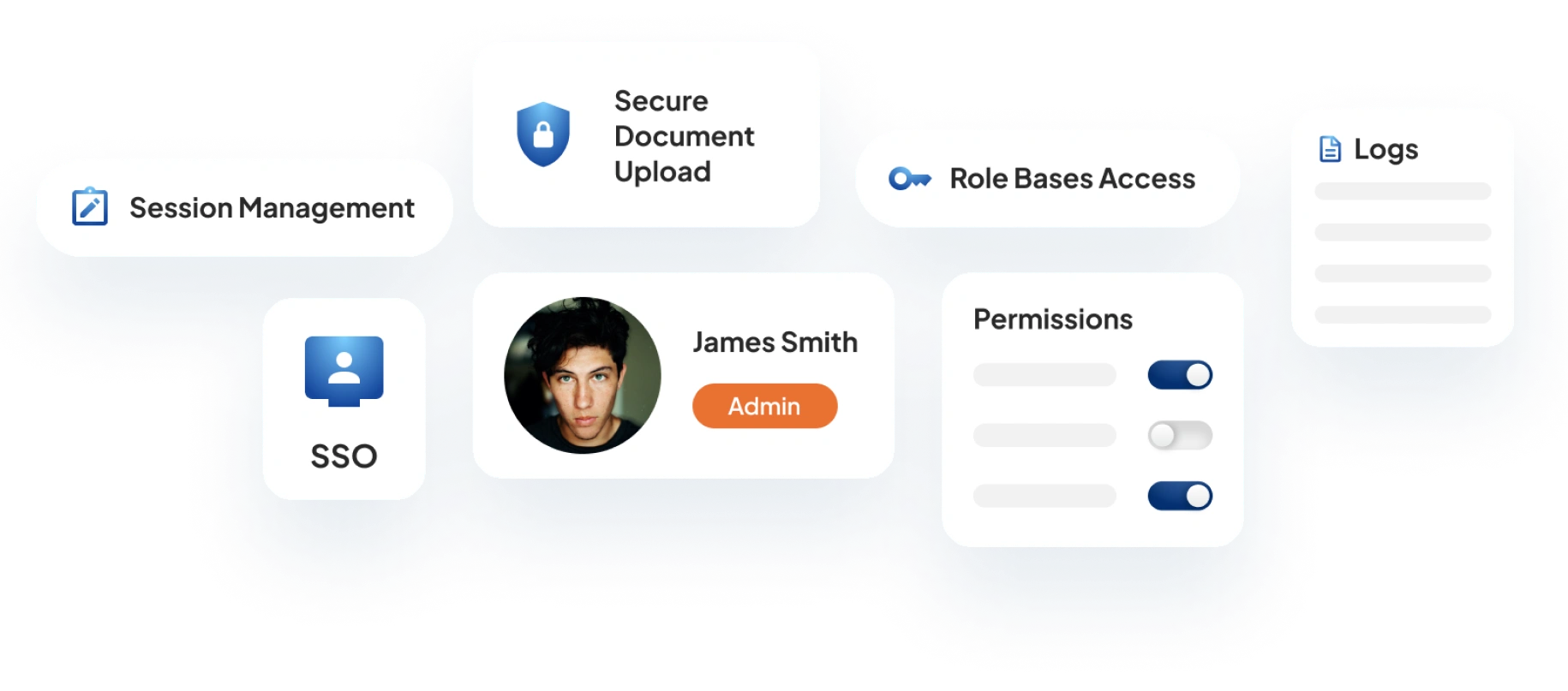

Compliance Complexity

Evolving regulations create inefficiencies and increase the risk of non-compliance.Built-in KYC and AML checks simplify compliance, ensuring adherence without delays.

Revolutionize Auto Lending with Algebrik‘s Smart Features

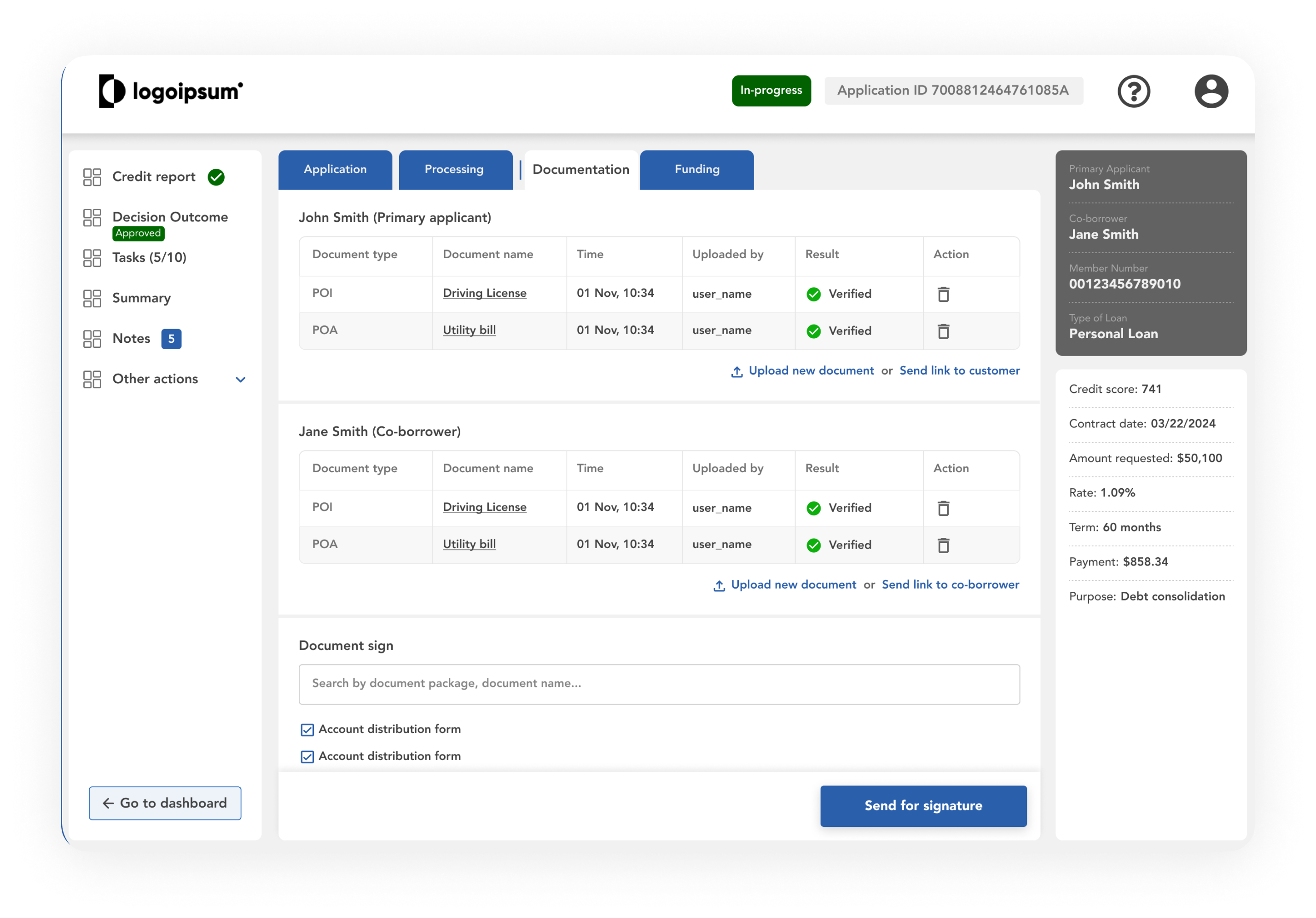

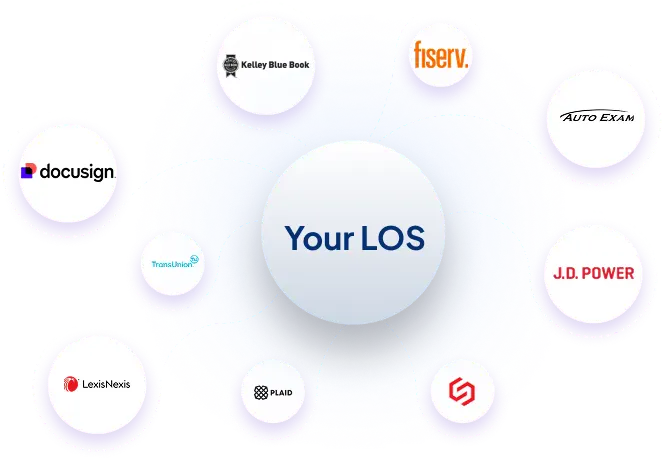

Get over disjointed systems

Banks struggle with disjointed systems, causing inefficiencies and borrower dissatisfaction.

One Platform. Multiple Integrations!

Algebrik unifies tools and automates workflows, simplifying lending for banks effortlessly

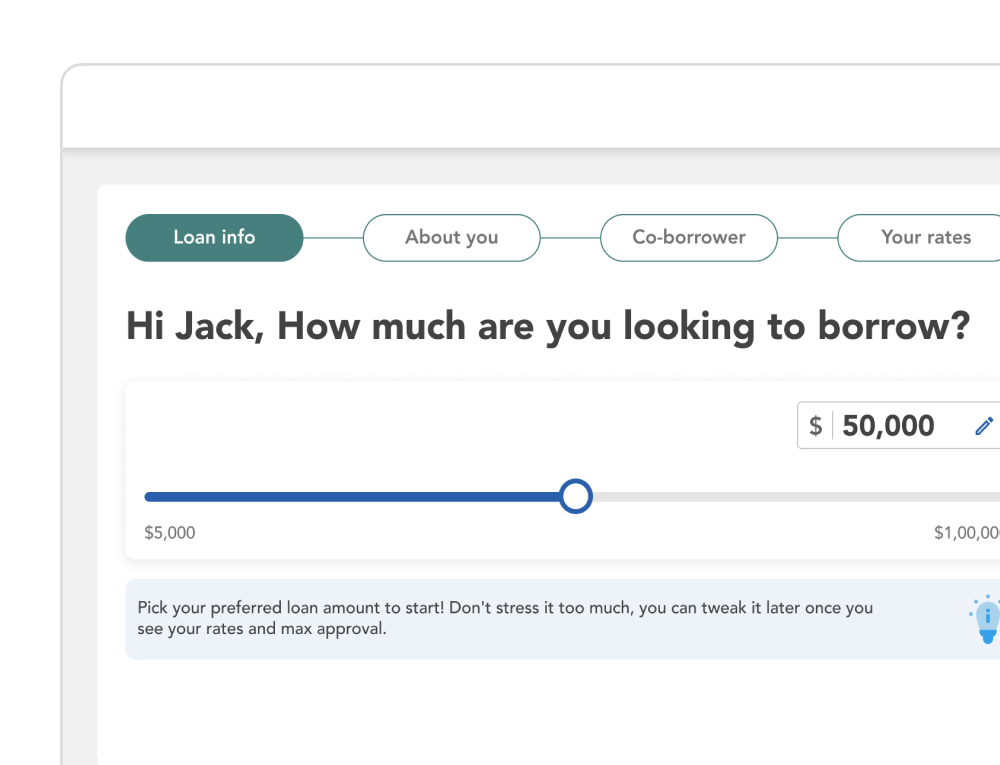

Unlock New Possibilities with Algebrik for banksLending

Achieve faster processing, lower costs, and higher borrower satisfaction with smarter workflows