Optimized for Auto Lenders, Tailored for Auto Owners

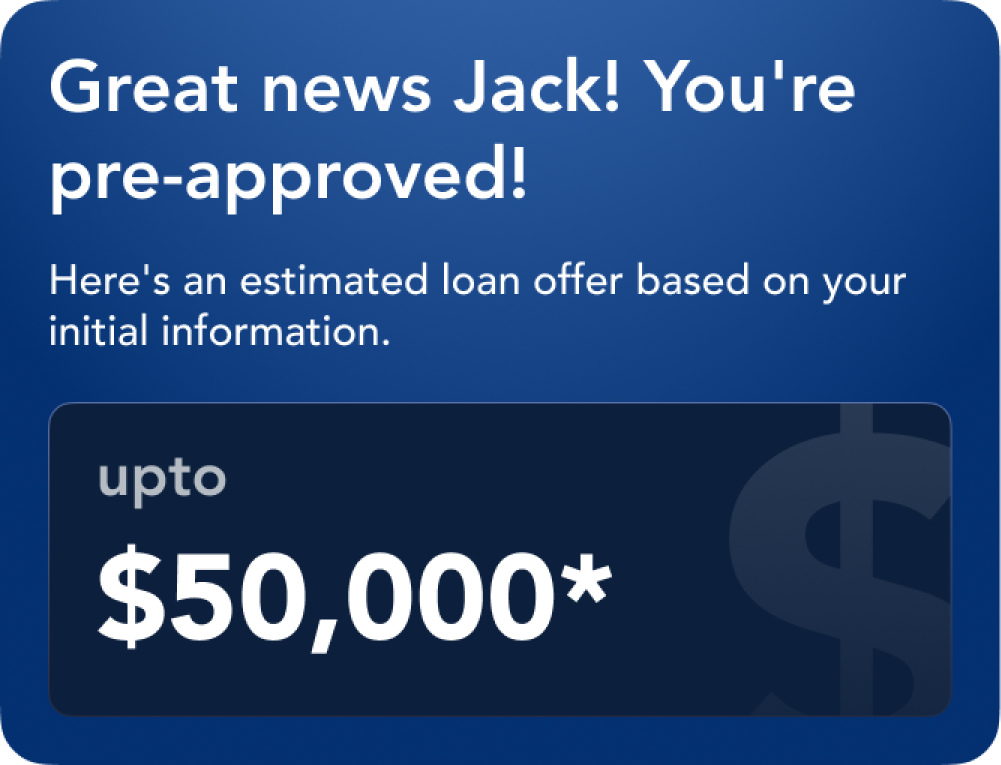

Smarter Lending Decisions

AI-powered insights streamline approvals, reducing friction for your team and borrowers

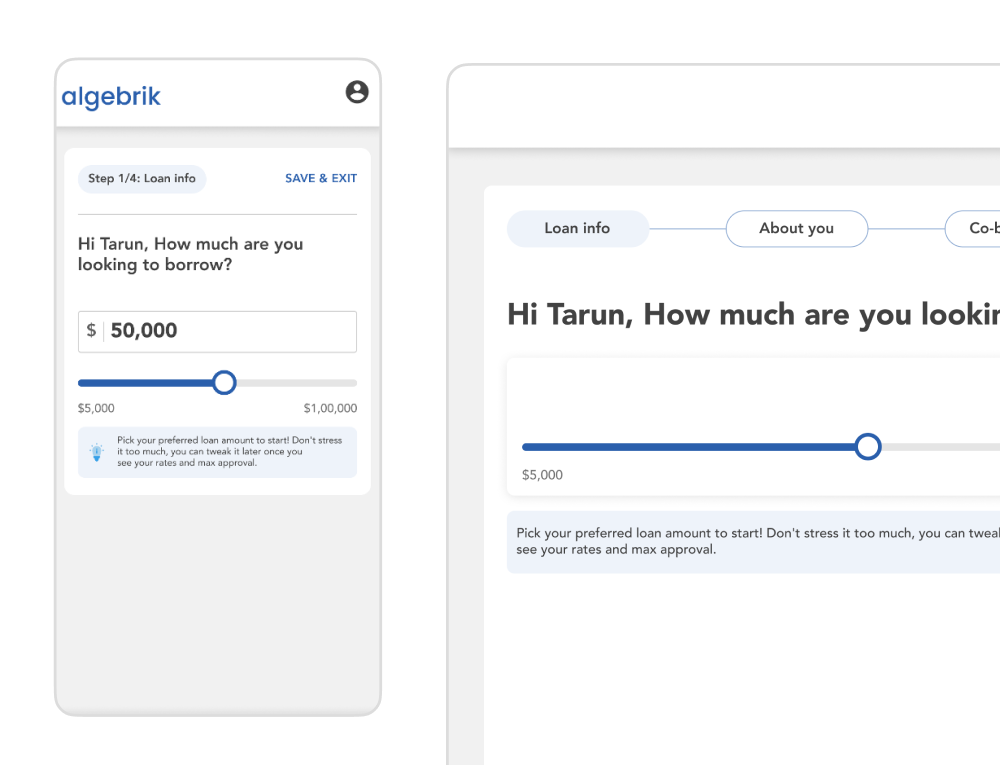

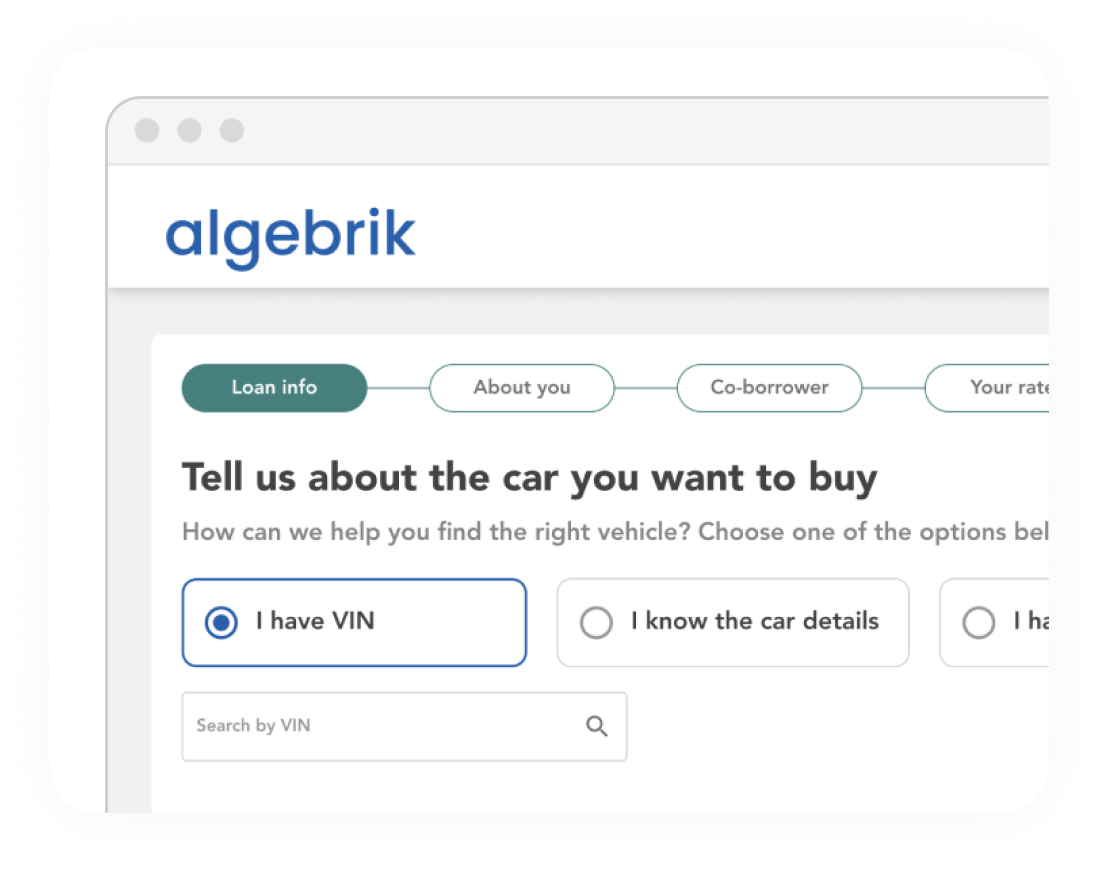

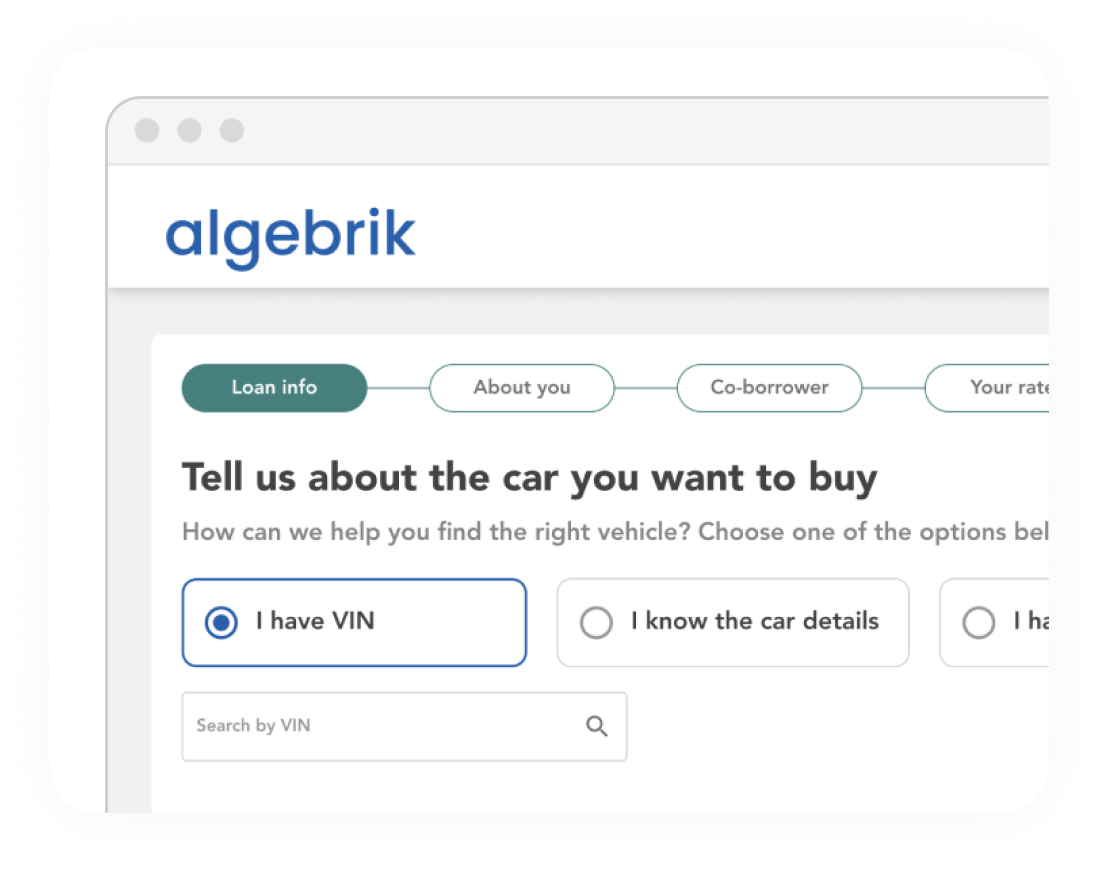

Seamless Borrower Journeys

Deliver connected experiences across dealership, mobile, and online channels

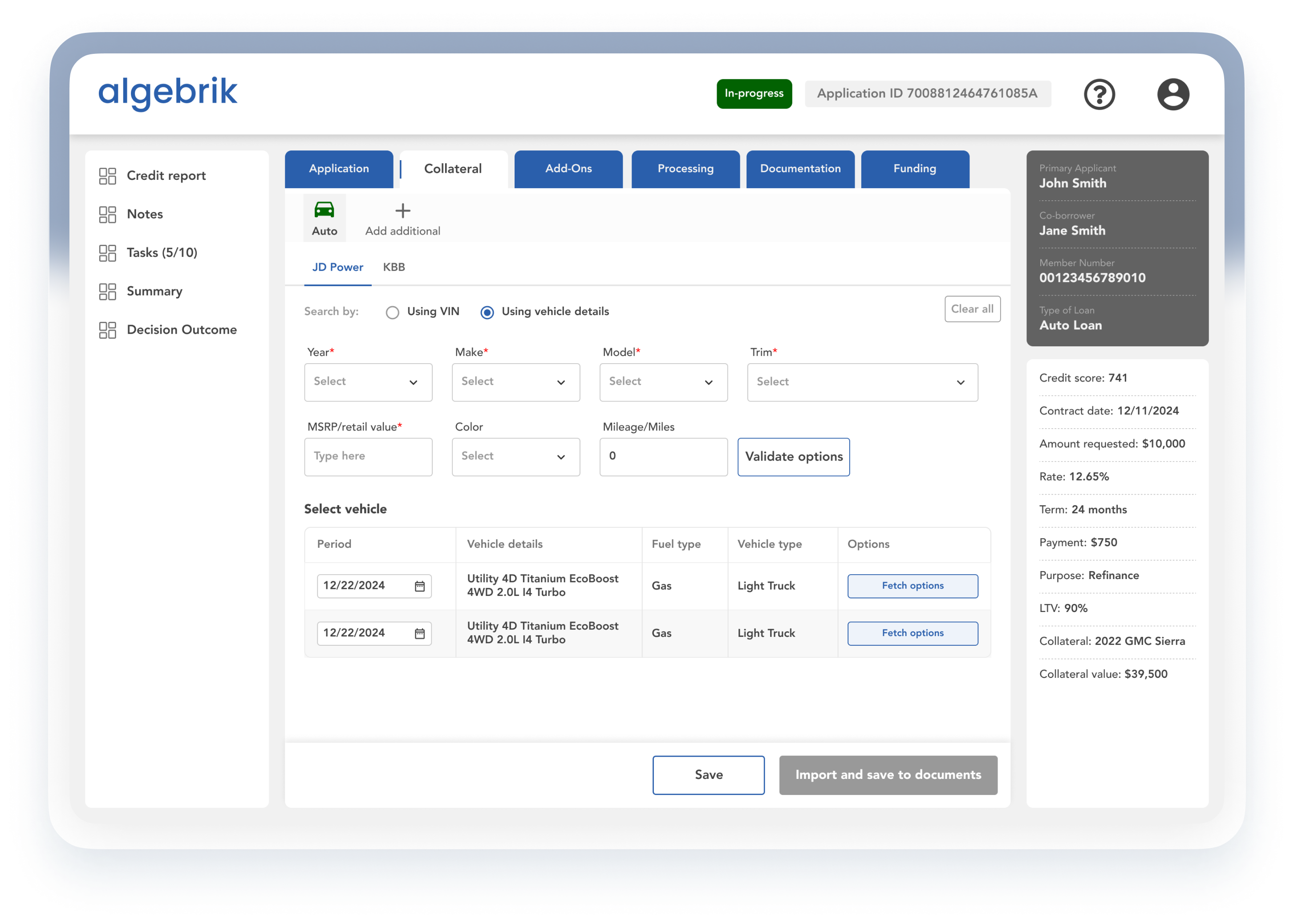

Integrated Workflows

Unify trusted services in one platform to minimize complexity and maximize efficiency

Smarter Lending Decisions

AI-powered insights streamline approvals, reducing friction for your team and borrowers

Seamless Borrower Journeys

Deliver connected experiences across dealership, mobile, and online channels

Integrated Workflows

Unify trusted services in one platform to minimize complexity and maximize efficiency

Overcoming Roadblocks in Auto Lending

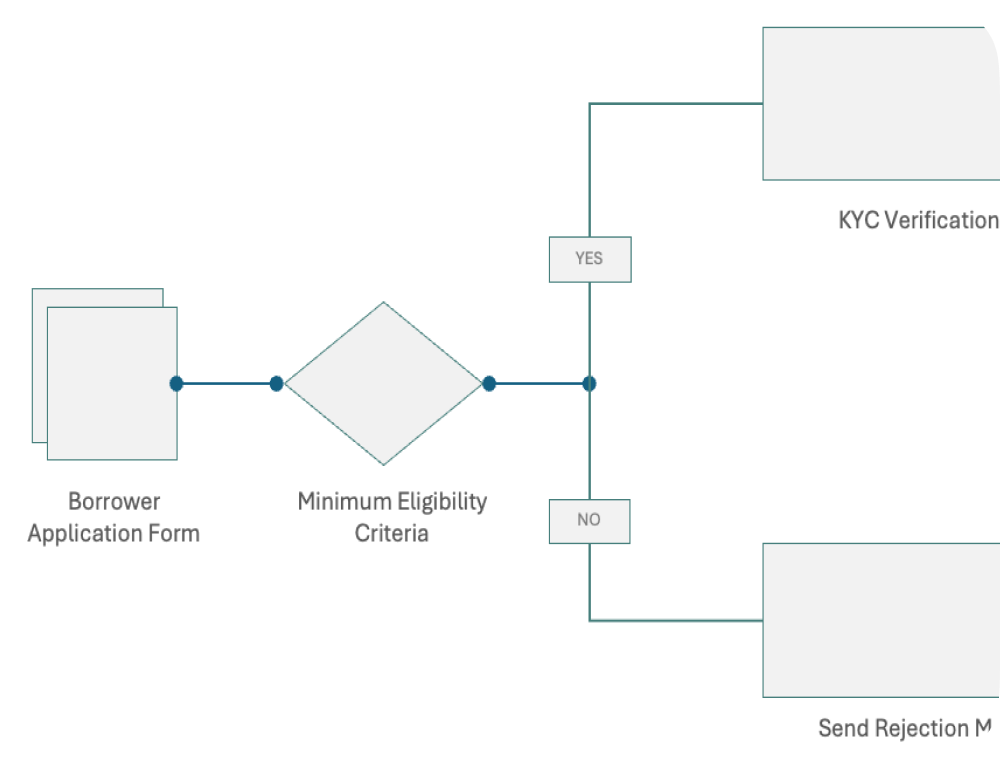

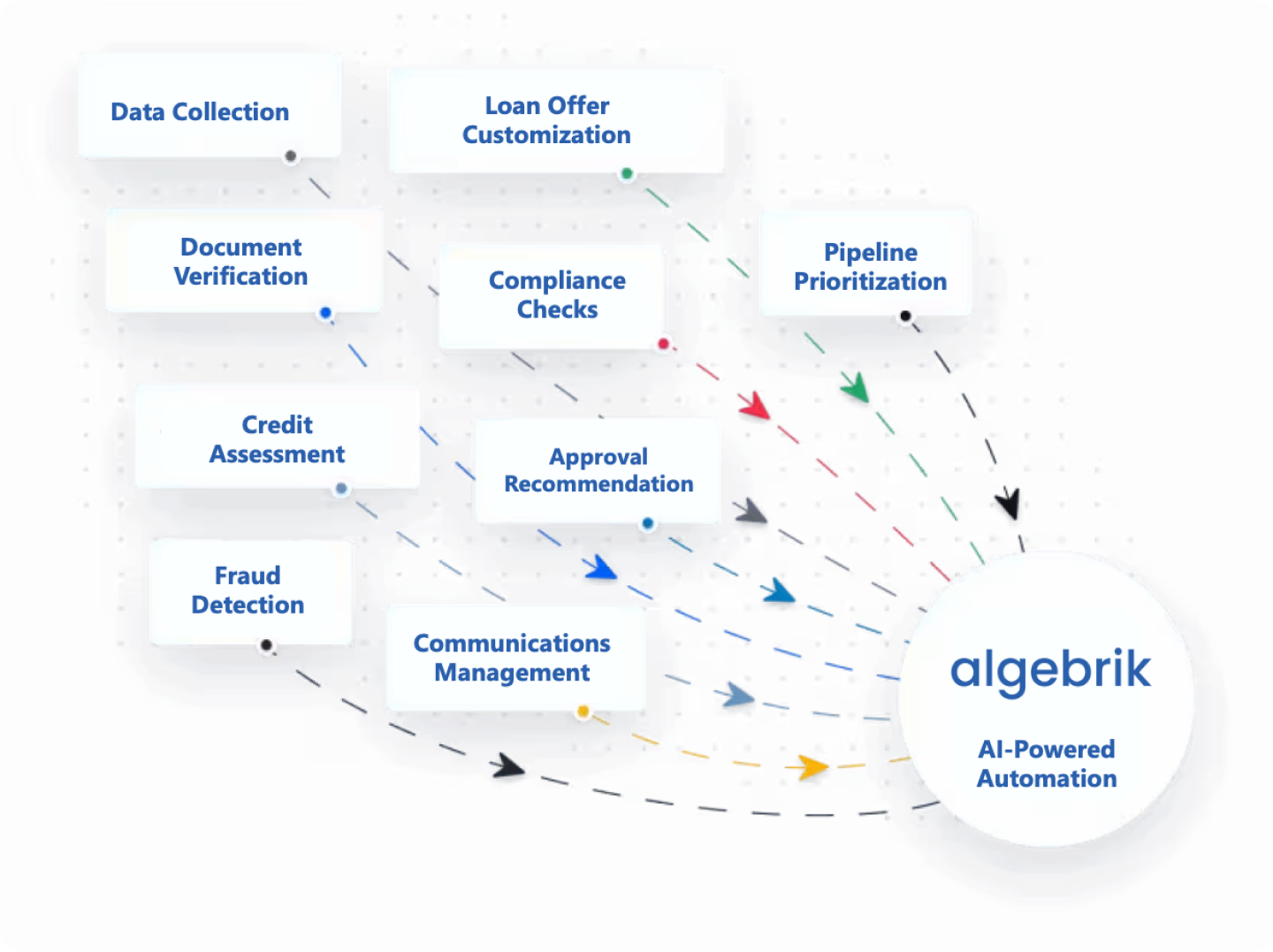

Operational Inefficiencies

Cumbersome manual processes lead to delays and lost opportunities.Algebrik automates workflows, reducing approval times and enabling faster service.

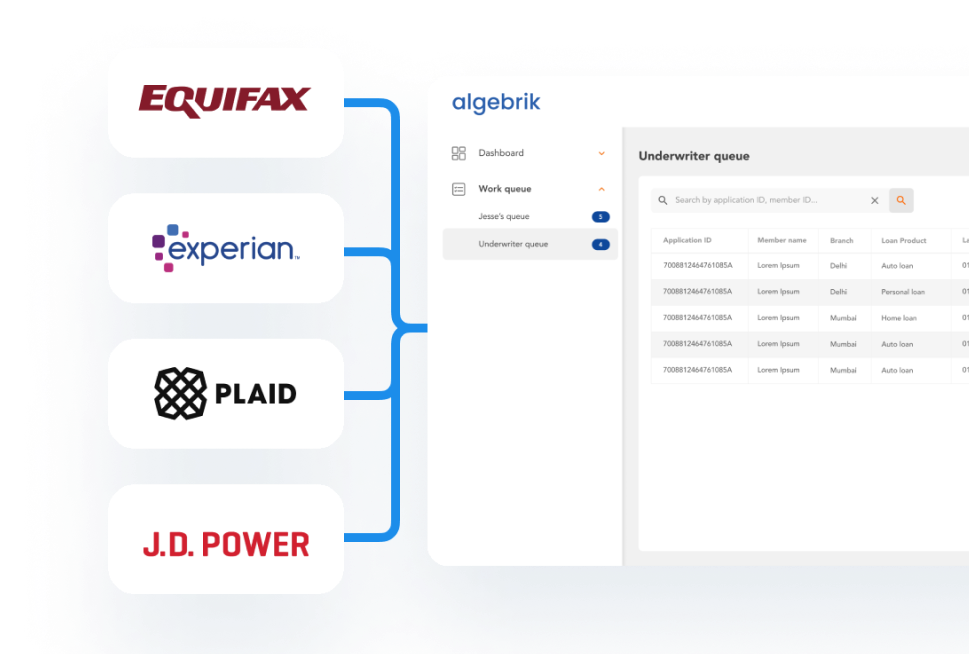

Managing Multiple Integrations

Juggling relationships with numerous data providers adds complexity and slows operations.Algebrik unifies trusted services in one platform, minimizing friction and enhancing decision-making.

Evolving Compliance & Accuracy

Evolving regulations and inaccurate valuations create compliance risks.Seamless integrations and real-time updates ensure your operations remain accurate and compliant.

Revolutionize Auto Lending with Algebrik‘s Smart Features

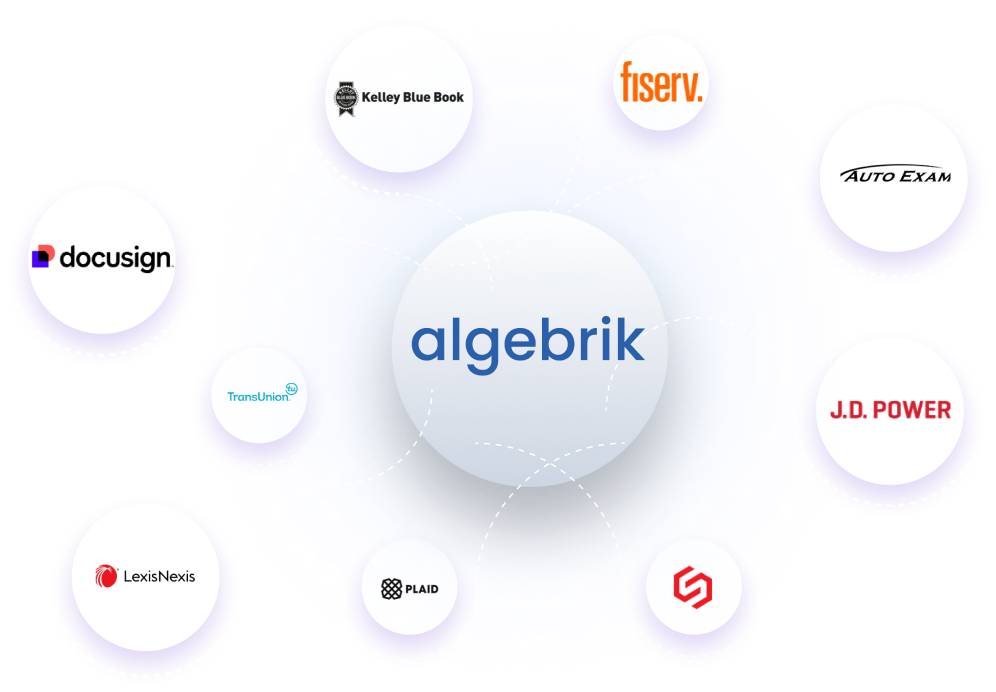

Plays Well With Others

Connect effortlessly with leading credit bureaus, income verification tools, DMV databases, and fraud detection systems.

And Brings Them Together

Algebrik unifies tools into one platform, simplifying workflows and eliminating the need for platform-hopping.

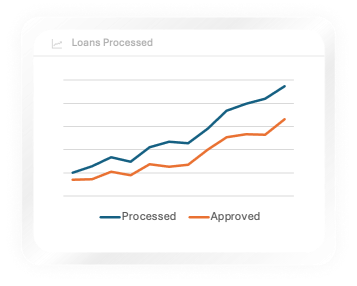

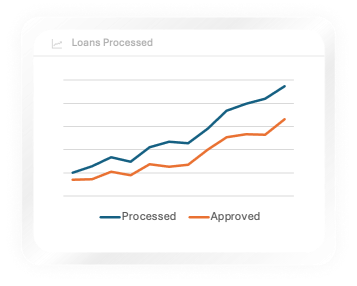

What Lenders achieve with Algebrik AI

Some numbers to tell the impact of using Algebrik AI