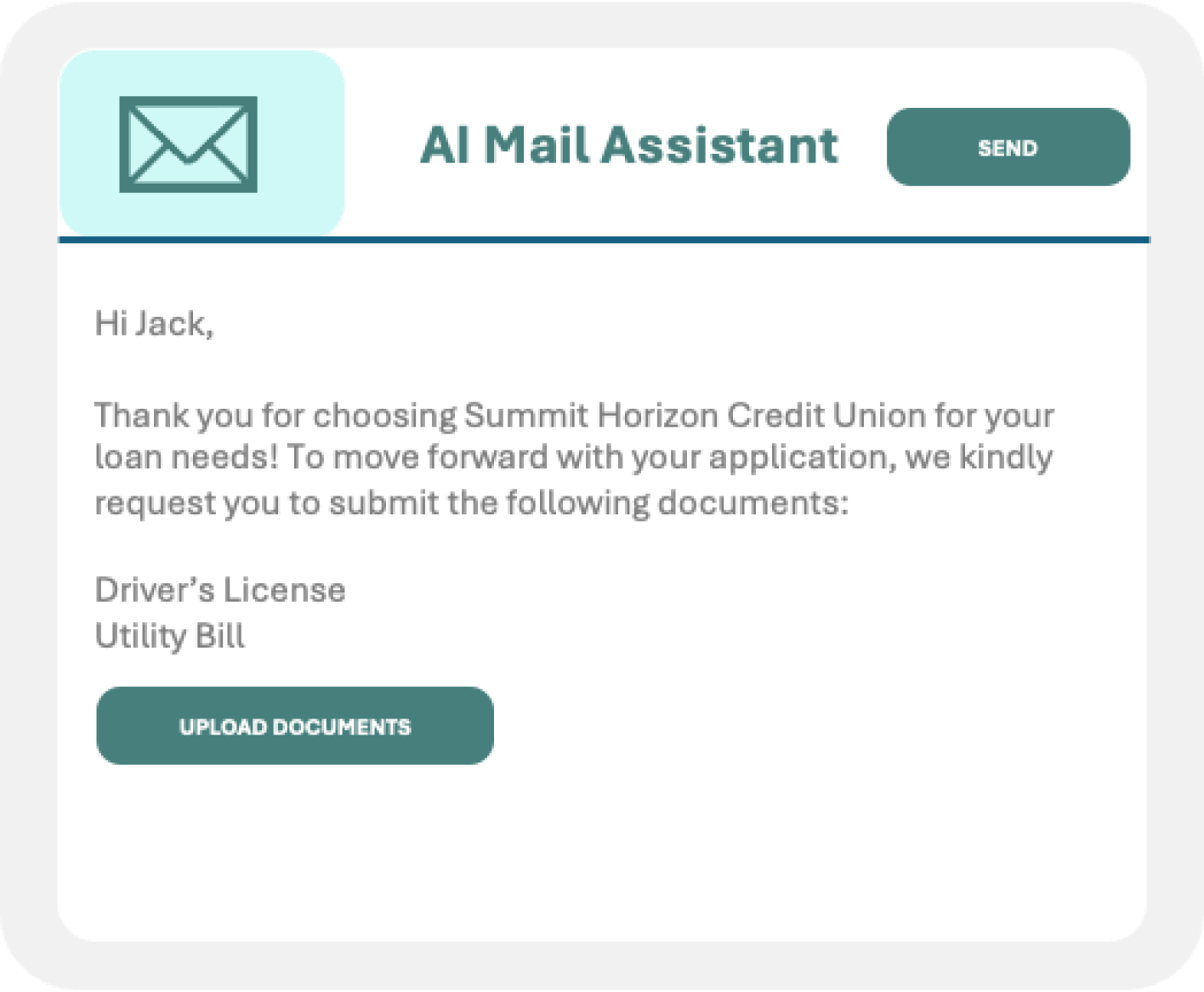

Borrower Communication

Fund Disbursement

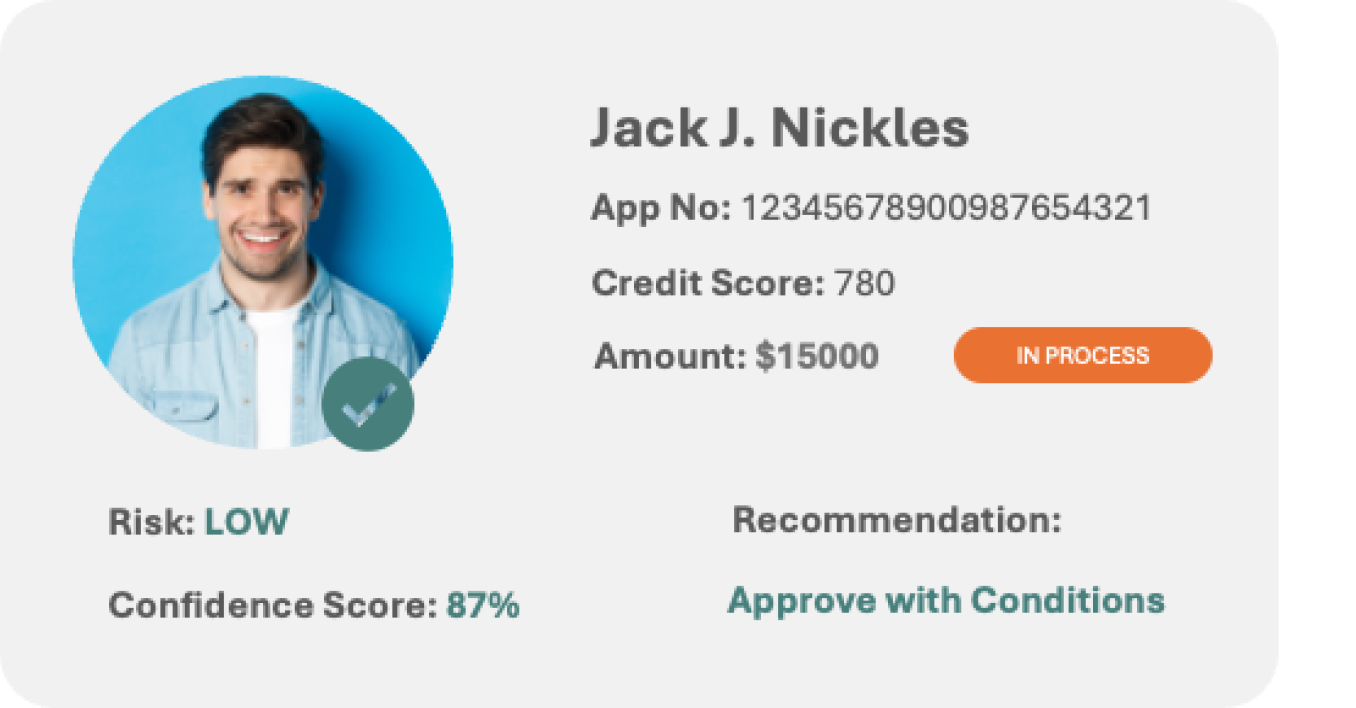

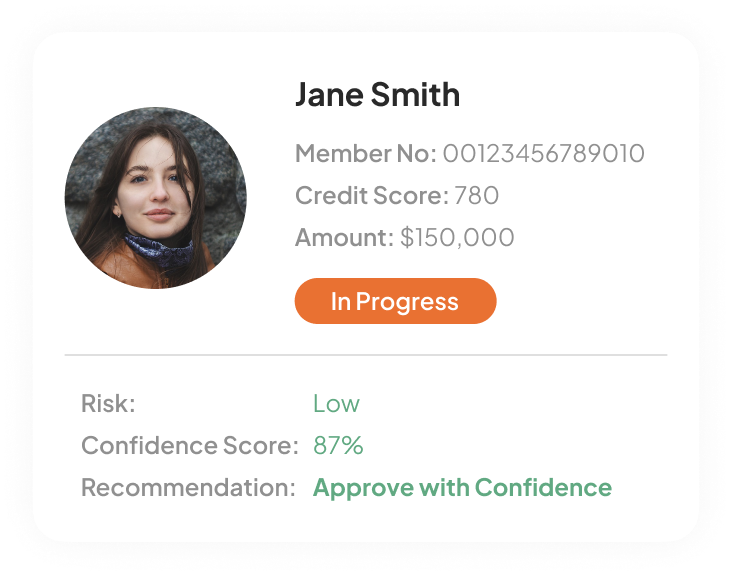

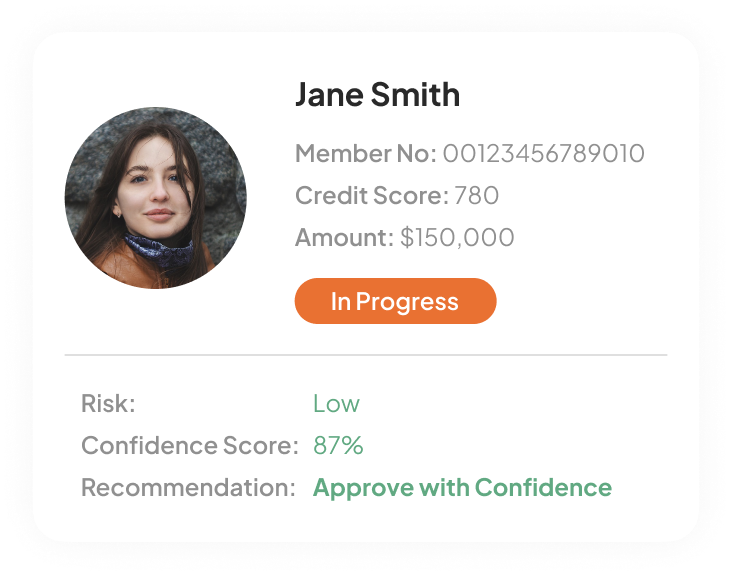

Borrower Verification

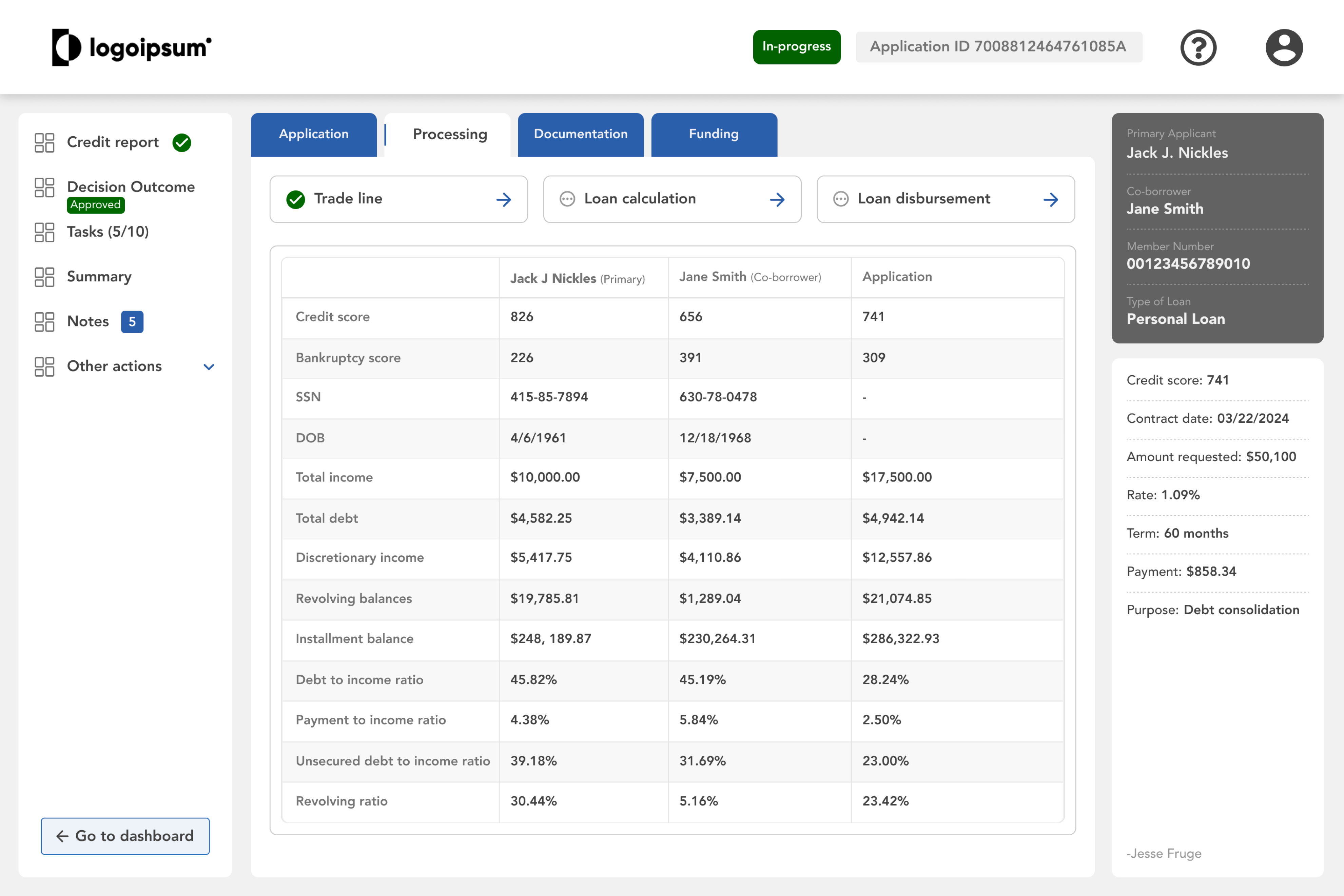

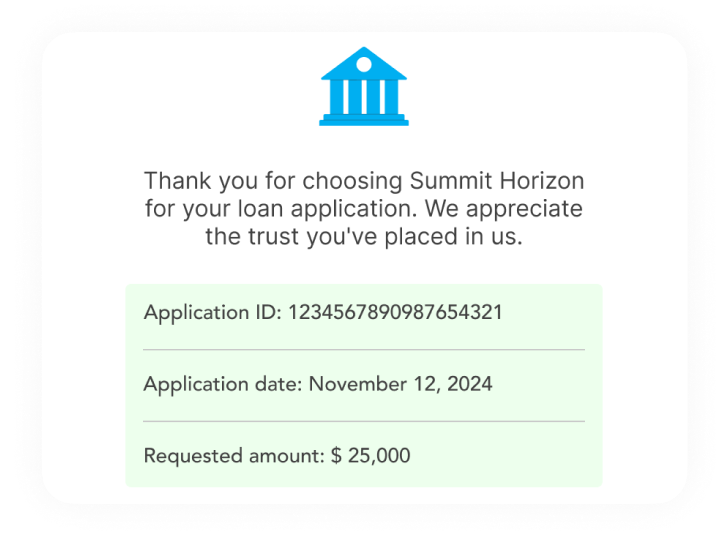

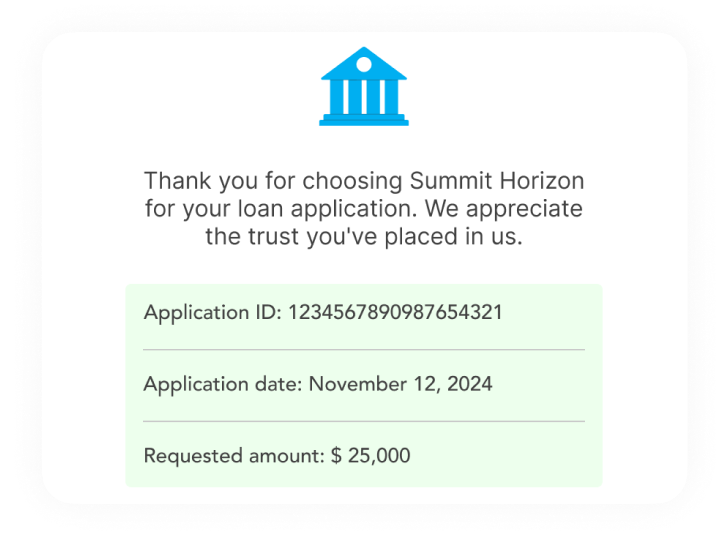

Origination

Application Management

AI-Lender Enablement

Agreement Generation

Document Processing

KYC Automation

Credit Scoring

Borrower Communication

Fund Disbursement

Borrower Verification

Origination

Application Management

AI-Lender Enablement

Agreement Generation

Document Processing

KYC Automation

Credit Scoring

Borrower Communication

Fund Disbursement

Borrower Verification

Origination

Application Management

AI-Lender Enablement

Agreement Generation

Document Processing

KYC Automation

Credit Scoring

Borrower Communication

Fund Disbursement

Borrower Verification

Origination

Application Management

AI-Lender Enablement

Agreement Generation

Document Processing

KYC Automation

Credit Scoring

Borrower Communication

Fund Disbursement

Borrower Verification

Origination

Application Management

AI-Lender Enablement

Agreement Generation

Document Processing

KYC Automation

Credit Scoring

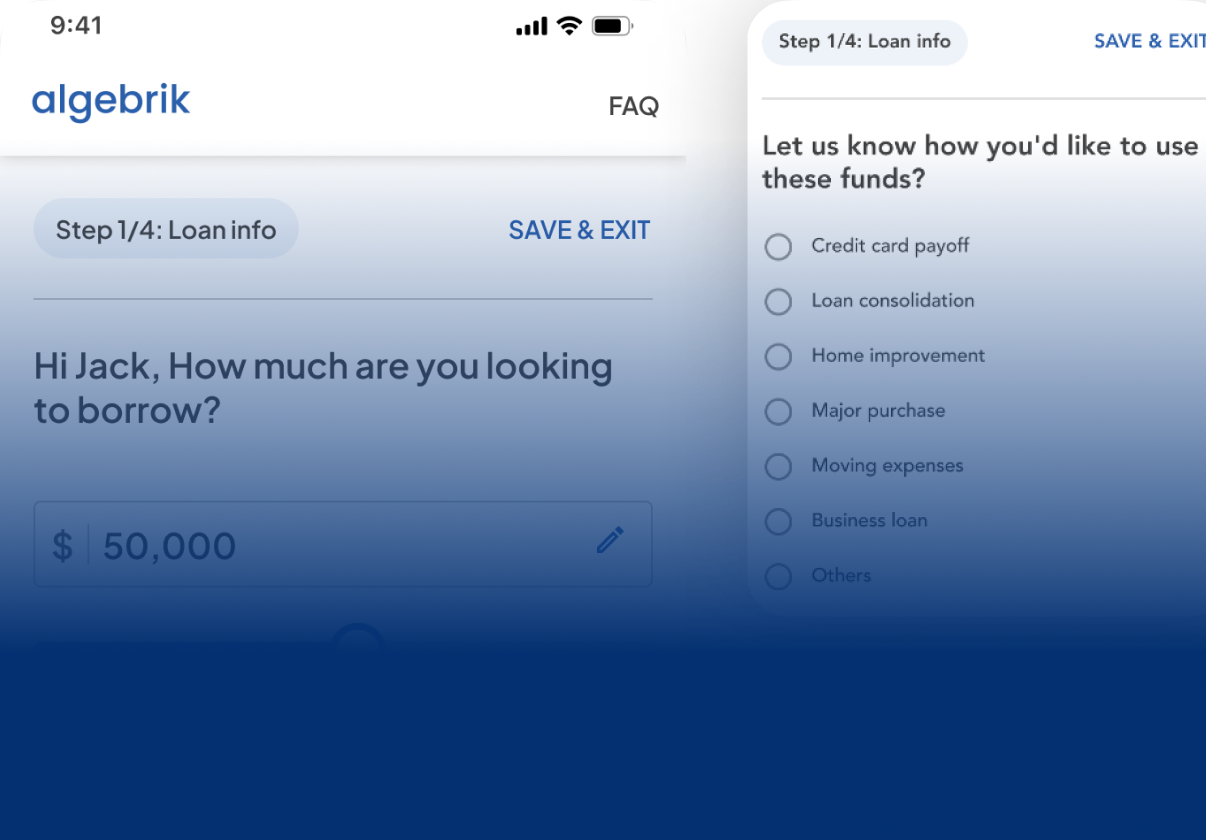

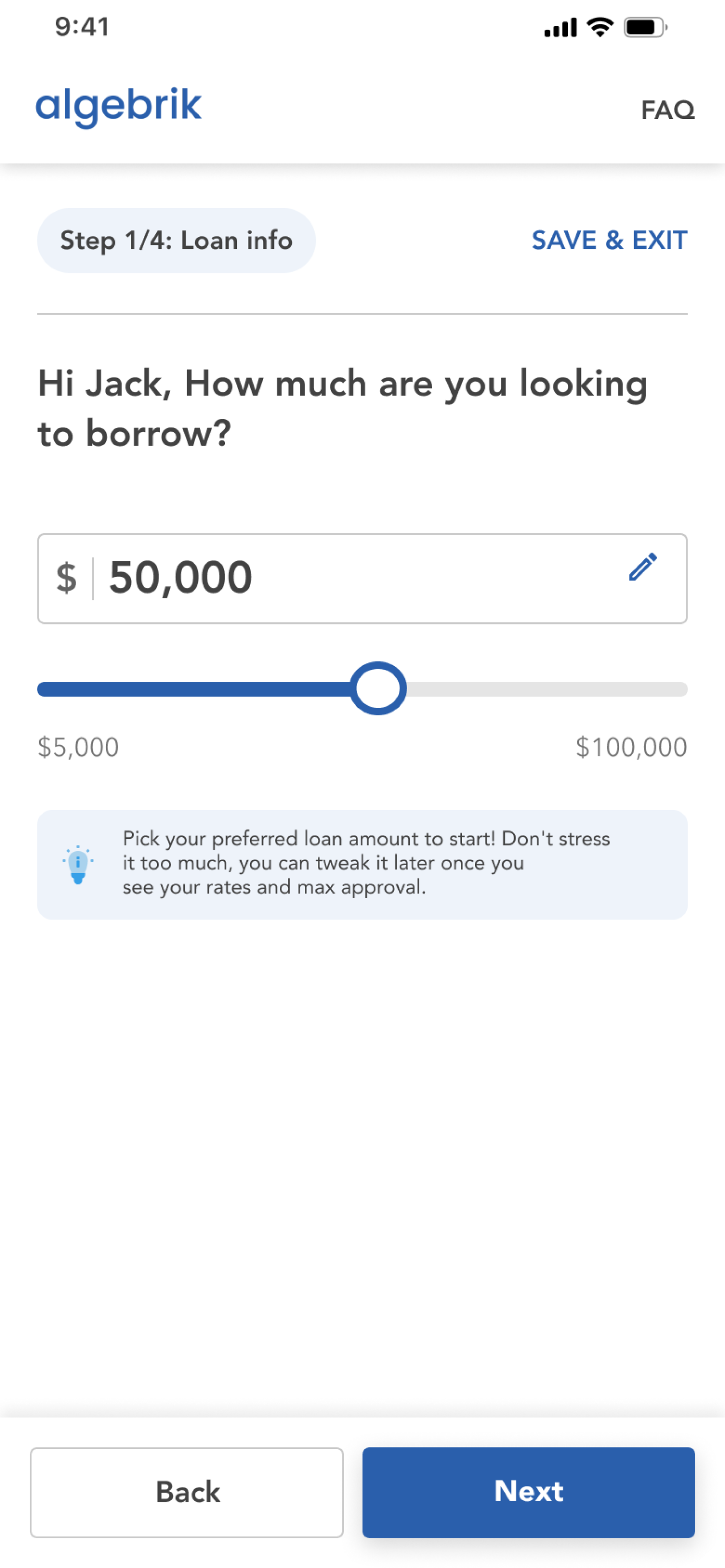

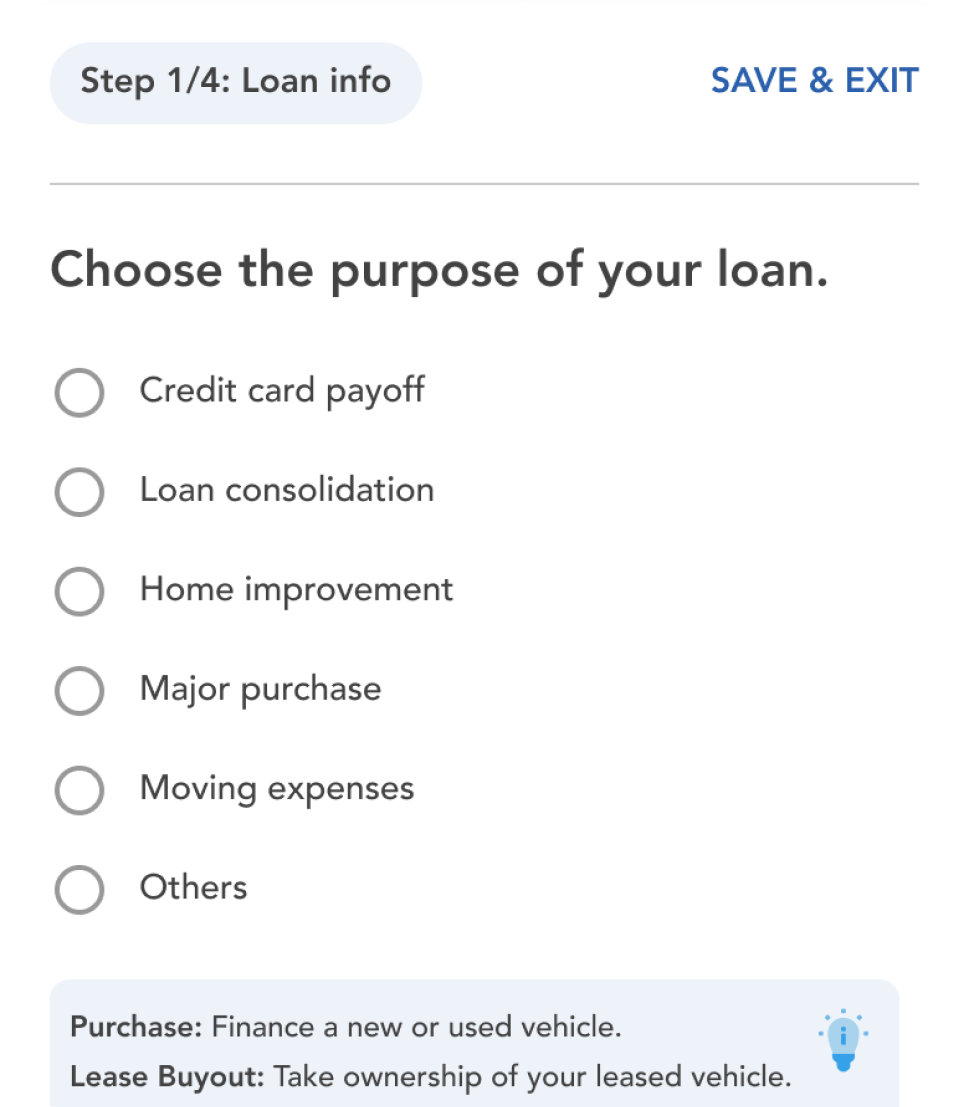

Building Better Borrower Journeys

Making Lending Journeys Faster, Smarter, and Simpler

Unlock Limitless Potential with Algebrik

Faster Loan Approvals

Reduce processing times by automating workflows, enabling approvals in minutes instead of days

Smarter Decision-Making

Leverage AI-powered risk analysis and predictive insights to make precise, data-driven decisions

Exceptional Experiences

Delight borrowers with seamless onboarding, real-time updates, and simplified agreements.

Faster Loan Approvals

Reduce processing times by automating workflows, enabling approvals in minutes instead of days

Smarter Decision-Making

Leverage AI-powered risk analysis and predictive insights to make precise, data-driven decisions

Exceptional Experiences

Delight borrowers with seamless onboarding, real-time updates, and simplified agreements.

Seamlessly Connected, Effortlessly Scaled

Check out the latest from the Originations Hub

news

Algebrik AI Joins the Jack Henry™ Vendor Integration Program

BusinessWire

news

Algebrik AI and Conductiv Elevate Lending with Permissioned Data, Automated Stipulations, and Smarter Underwriting

Team Algebrik

news

Algebrik AI Partners with Carleton to Elevate Lending Accuracy and Compliance

BusinessWire

news

Algebrik AI and Corelation Announce Integration Agreement to Enhance Personalization, Drive Financial Inclusion & Improve Member Experience

BusinessWire

news

Algebrik AI and Plaid Join Forces to Simplify Loan Approvals with Smarter, Faster Data Connectivity

BusinessWire

news

Algebrik AI Partners with Auto Exam to Seamlessly Deliver Auto Loan Protection Solutions

BusinessWire

news

OTTOMOTO® Partners with Algebrik AI to Enhance Embedded Lending with AI-Driven Insights

BusinessWire

news

Scienaptic AI co-founder steps down to launch new venture, Algebrik AI

Fintech Futures

news

Algebrik AI Secures $4M in Series A to Disrupt the Global Loan Origination Software Market

BusinessWire

news

Algebrik AI Expands Founding Leadership Team with the Appointment of Jesse Frugé as VP of Product Management

BusinessWire

news

Algebrik AI: $4 Million (Series A) Raised To Advance Cloud-Native Loan Origination Platform

Pulse 2.0

news

Algebrik AI Strengthens Founding Leadership with Appointment of Andrea Silvers as VP of Business Development & Partnerships

BusinessWire

news

Algebrik AI Announces Visionary Advisory Board to Transform the Future of Lending

BusinessWire