Now Live: Lanes, Loans & Long Hauls!

Team Algebrik

3 min read

July 9, 2025

A Product Peek into What’s New at Algebrik this Month

At Algebrik, every product update is a chance to simplify complexity—and July is no different. Whether you're navigating indirect channels or financing a family’s first road trip RV, this month’s releases are designed to take the load off your lending teams.

Let’s dive in:

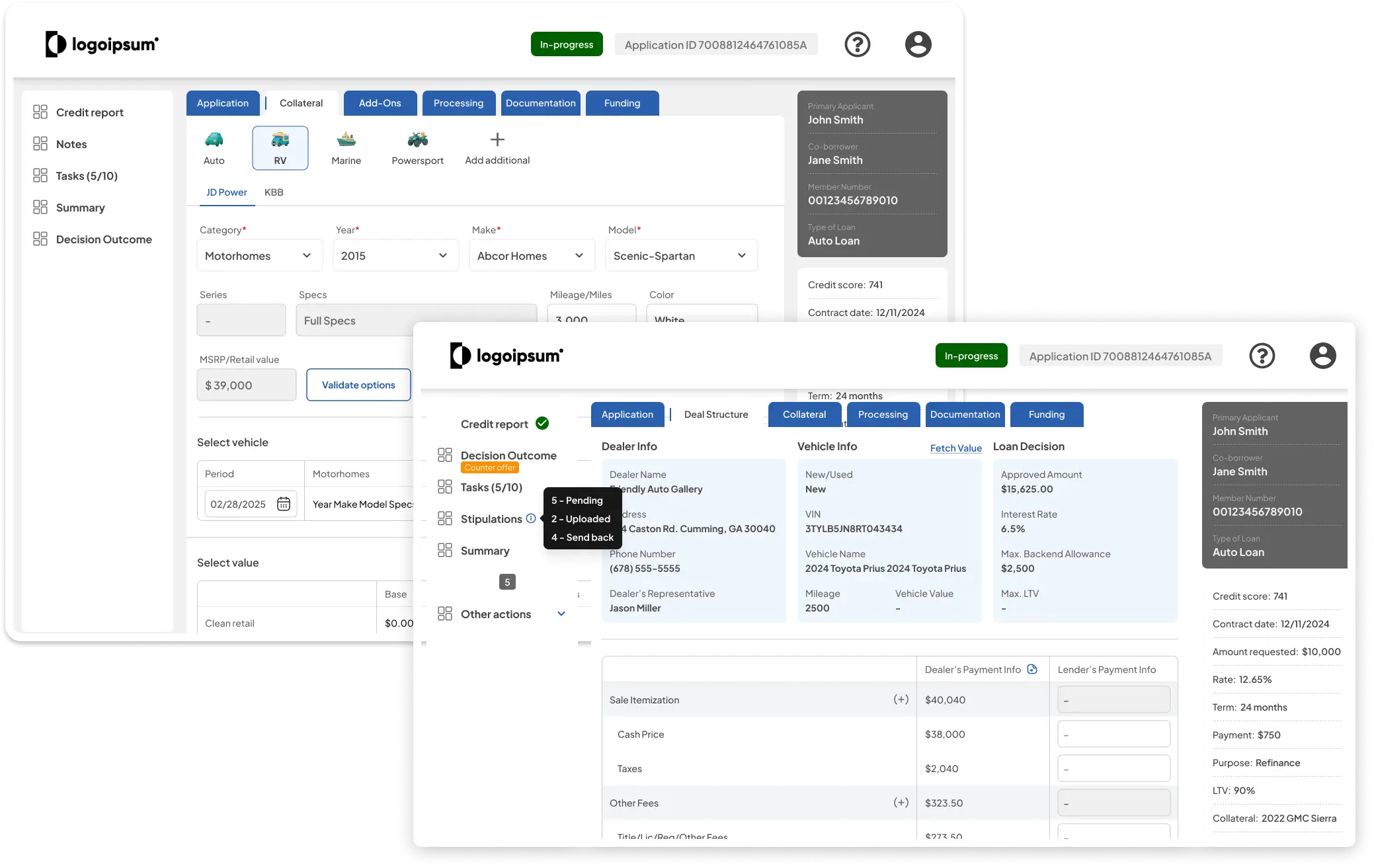

Indirect Lending, Built the Algebrik Way

What’s New:

Our Indirect Lending module is now fully live—bringing structured, intelligent, and compliance-ready workflows to a historically clunky process. This isn’t a bolt-on fix. It’s a native, deeply integrated extension of your lending ecosystem.

What It Enables:

- Dealer-Driven App Flow: Receive, track, and triage applications from your dealer partners, with built-in logic to avoid duplication or rekeying.

- Pre-Qual to Contract in One Flow: Start with soft pull or hard pull, validate key details, run pre-configured policies, and send decisions—without jumping across tools

- Dealer Portal Integration: Currently optimized for RouteOne, AppOne, DealerTrack, OttoMoto support. Lenders can now configure rules on which dealers can route apps, volume limits, and auto-decisioning preferences.

- Stipulation Mapping for Third Parties: Stips like proof of insurance, invoice from dealer, or lien details can now be routed to the responsible party—dealer or borrower.

- Real-Time Audit Trails: Every update, approval, counter-offer, and communication is logged and reportable—reducing risk and saving ops hours.

Why It Matters:

Indirect lending has long been a growth lever—but also a patchwork of portals, spreadsheets, and delays. Algebrik brings it into the modern era: fast, clean, and deeply embedded into your lending core. Whether you’re scaling dealer relationships or tightening controls, it’s all one cohesive experience.

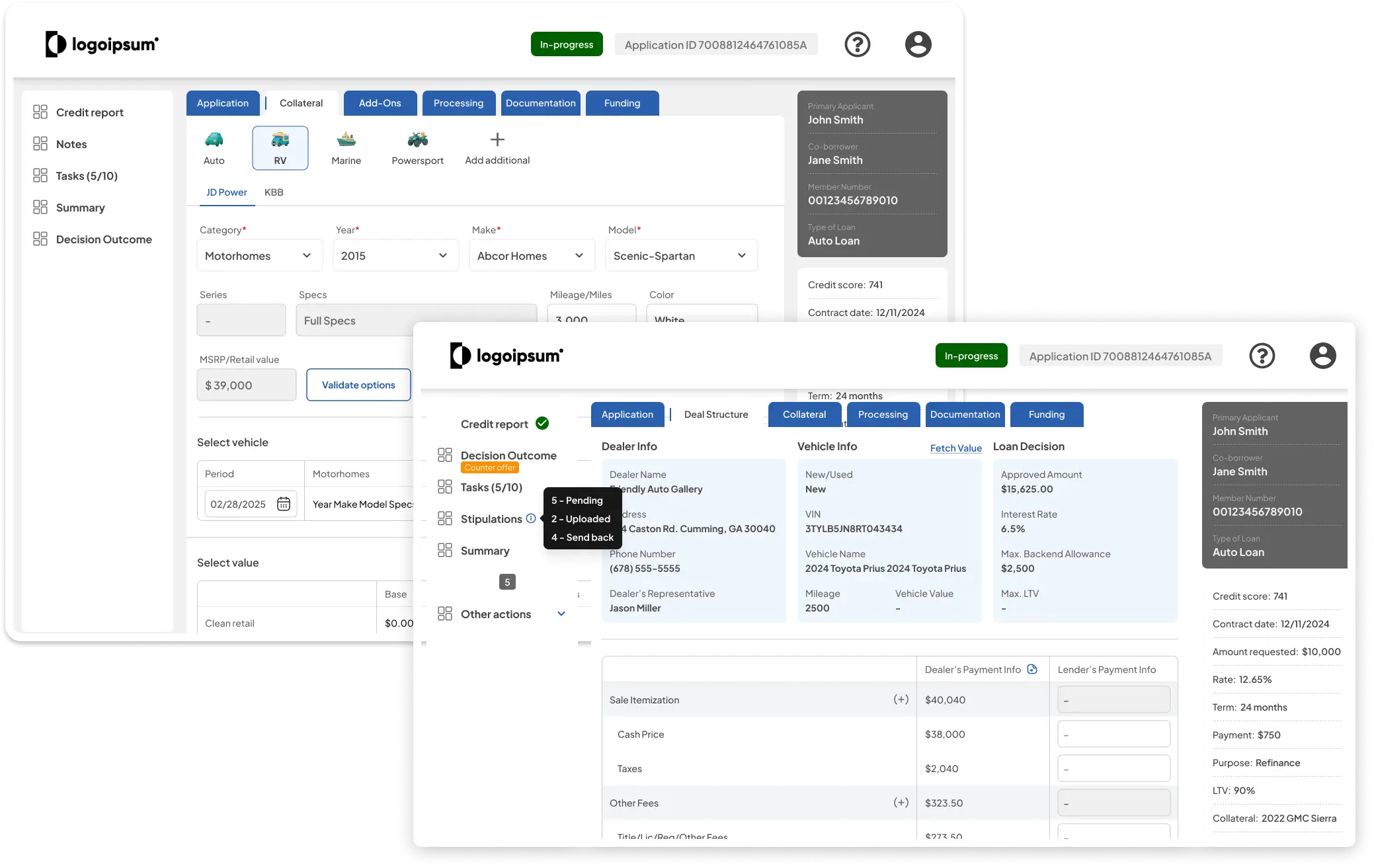

Recreational Lending for the Long Haul: RVs Now Supported

What’s New:

Our support for RV lending is now officially complete, making it easy to handle one of the most unique asset classes in consumer lending. This isn’t just auto lending with a new label—it’s built ground-up for the nuances of RV finance

What’s Included:

- RV-Specific Fields: Capture critical details like RV type (Class A/B/C, towable, etc.), length, number of slide-outs, and year of manufacture.

- Custom Stipulation Library: RV loans often require different documentations—insurance binders, and lien documentation for titled trailers. Our stipulation module now includes these pre-baked templates.

- Asset Valuation Integration: JD Power integration allows instant asset lookup and value anchoring—so your LTV ratios stay accurate.

- Branch, Mobile, and Dealer Ready: Whether it’s an online application, a branch visit, or indirect channel—RV loans can now be sourced, underwritten, and closed across all origination surfaces.

Why It Matters:

RV loans are rising fast—not just in volume, but in borrower expectations. As consumers seek lifestyle-based financing, offering RV loans with the same speed, clarity, and confidence as a personal or auto loan can set your institution apart. With Algebrik, you can launch, scale, and refine RV lending without retooling your stack.

Coming Next...

Here’s what we’re rolling out soon:

- New partner integrations for identity, fraud, and compliance checks (Wait for the next edition for the reveal!)

- Embedded Account Opening workflows to grow member relationships earlier in the funnel.

As always, let us know what you’re excited to see next—or where we can reduce friction for your teams and borrowers.

Lending is evolving—faster journeys, smarter decisions, and more personalized experiences aren’t just nice to have; they’re expected. At Algebrik, every release is a step toward that future.

Whether you're expanding your indirect footprint or rolling out new loan types, we’re building the infrastructure to support you—with intelligence, flexibility, and ease at the core.

Thanks for being on this ride with us.

Until next month—keep lending smarter.

—The Algebrik Product Team

More Blogs

Blog

New in Algebrik: Capture the HELOC Market, Onboard Members in Minutes, and Outsmart Identity Fraud

Blog

Why Legacy Loan Systems Are Guaranteeing Failure (And the New 30% Opportunity)

Blog

Is Your Technology Handing the Next Generation to the Competition?